Key takeaways from this article:

- Working with a local Cape Verdean lawyer can help to ensure a seamless buying process.

- We do not recommend sourcing a mortgage in Cape Verde.

- Additional expenses like fees, taxes, and other buying costs typically increase the final purchase price of a property by about 6%.

- These extra costs include (but may not be limited to): lawyer fees, power of attorney, purchase tax, land registry fees, and notary fees.

- Keep an eye out for ongoing fees, like property management fees and IUP tax.

Step 1: Sourcing your new property

The first stage to finding your ideal property in Cape Verde is to look online or in person at the available options. We recommend that you research the islands individually, as the cost of living and lifestyle can differ depending on which one you choose.

Sal and Boa Vista tend to be the most popular options for international buyers, however you can also find great deals on the other islands.

A quick online search for available property on your desired island will direct you to the relevant real estate brokers.

Once you’ve found your desired property and identified the purchase price, you’ll then register your interest in the property through the broker.

Make sure to also take into account any hidden fees that may be applicable to the property. Read on to find out what these fees are, and how they may vary by property!

Tip: Take the time to look at as many options as possible, considering utilities offered and location.

Step 2: Consulting a local lawyer

You will now need to get in touch with a lawyer who is based in Cape Verde. Their role is to ensure all paperwork is correct, as well as fill out the necessary forms.

Hiring a lawyer for this case in Cape Verde typically costs between €600 and €1000.

At this point, you will also need to do a power of attorney so that the lawyer can act on your behalf at the notary in Cape Verde. This can be done either locally (in Cape Verde) or in your home country:

- In Cape Verde: You will get in touch with your lawyer who will prepare the necessary documents for you to sign.

- Outside Cape Verde: Your lawyer in Cape Verde will prepare a form which you will sign and deliver to your nearest Cape Verde embassy or notary public lawyer.

Arranging the power of attorney in Cape Verde on average costs between €60 and €100.

Step 3: Brokering a deal

Communicating through your broker, you’ll then come to a preliminary deal on the property.

This usually includes paying a reservation fee, which is approximately €3000 or 5% of the property value. Once this is paid, the property is officially taken off the market.

The reservation fee typically pays towards the final deposit for the property.

The deal will also include any brokerage fees that may be payable. In many cases, the brokerage fee is split evenly between the buyer and seller, however this may vary so make sure to thoroughly check the deal.

A promissory contract may also be signed at this point, which provides added security for the buyer and the seller.

Step 4: Arranging the closing statement

Once the power of attorney has been completed, your local lawyer will then create a closing cost statement with relevant charges and tax. This will be taken by the lawyer to the Cape Verdean notary where the documents for the property will be signed on your behalf.

Step 5: The final deposit

Following the closing statement, the final deposit will need to be sent to the seller. There are a couple of ways in which you can do this:

- Sending the money directly: Through contact with the seller, you can transfer the money directly to the seller’s bank account. If they are based outside of Cape Verde, this helps to avoid transferring the money inside Cape Verde and then outside again.

- Sending the money indirectly: For extra security, you can send the money through your lawyer in Cape Verde. Please note that this may incur additional transfer tax and potential delays.

Are there any hidden costs when buying property in Cape Verde?

There are a few extra costs during the buying process that you will need to be aware of. These include:

IUP Tax

The IUP tax is a local council tax that is paid yearly in two instalments. The taxable amount will vary depending on the value of your property, however, for a €100,000 property, the amount will roughly be €300 split across two instalments per year.

Management fees

Purchasing properties such as an apartment or resort home will also have management fees tied in. This fee will also vary depending on the property managers, but you can expect a two-bed apartment in Santa Maria to cost up to €500-1000 a year.

That said, it is possible to find flats with low condominium fees, well below €500 euros a year.

Purchase tax

This is a straightforward 1.5% tax that is paid on top of the value of the property during the buying process. Double-check this value with your lawyer as it may vary.

Extra costs

There will be a few extra costs involved in the buying process. The local land registry fees and notary fees will cost around €700 (granting you a land registry certificate). You may also need to pay translation fees, registration fees and bank fees.

Can I get a mortgage in Cape Verde?

Mortgages can be difficult for foreign nationals to get in Cape Verde, as they involve a slow and often expensive process with unfavourable rates. To avoid this, we recommend that you raise the capital in your home country first.

What is the Green Card (Investor Visa)?

While there is no official citizenship by investment program, Cape Verde offers a path to citizenship through investment. The law allows for citizenship to be granted without residency requirements to those who make a substantial investment in the country, normally around 200,000 EUR or more.

This investment can be in the form of real estate, such as purchasing a house in popular areas like Boa Vista, Sal, or Santiago. It can also potentially take other forms (such as a business) depending on the investor’s circumstances.

The investor’s spouse and children are also eligible for citizenship under the same qualifying investment.

You can apply for this residency on the official Cape Verde eResidencia website.

Popular areas to buy property in Cape Verde

Sal: Santa Maria

With stunning beaches and a breathtaking landscape, Sal boasts year-round warm weather. The island is also easy to access thanks to its international airport, which is a 20-minute taxi ride from Santa Maria.

Sal also has plenty of international restaurants offering a diverse variety of cuisines – it’s certainly an island that is tailored to visitors from around the world. You’ll find a vibrant nightlife scene and enjoy a lower cost of living than many other places in Europe and North America.

Here in Santa Maria, you can find simple flats starting from around €30,000. However, prices can rise much higher for more luxurious properties.

Boa Vista: Sal Rei

For those looking for a slow pace of living in a warm and inviting environment, consider Boa Vista – the perfect location for a holiday home or a permanent residence. From the white sandy beaches to the delicious local seafood, it’s a fantastic place to relax and unwind away from the stresses of modern life.

The city of Sal Rei is the most accessible area on the island for international buyers, with easy links to Boa Vista’s airport and harbour.

São Vicente: Mindelo

While it can be tempting to rush to explore the more internationally well-known islands like Sal and Boa Vista, we highly recommend exploring some of the other islands – you might be pleasantly surprised!

As the unofficial cultural capital of the islands, Mindelo in São Vicente has a rich history and a vibrant music and arts scene. The old colonial architecture in the historic city centre is full of charm, there are also beautiful beaches to explore. You can enjoy all the amenities and activities of city life, while still making the most of Cape Verde’s traditional laid-back island atmosphere.

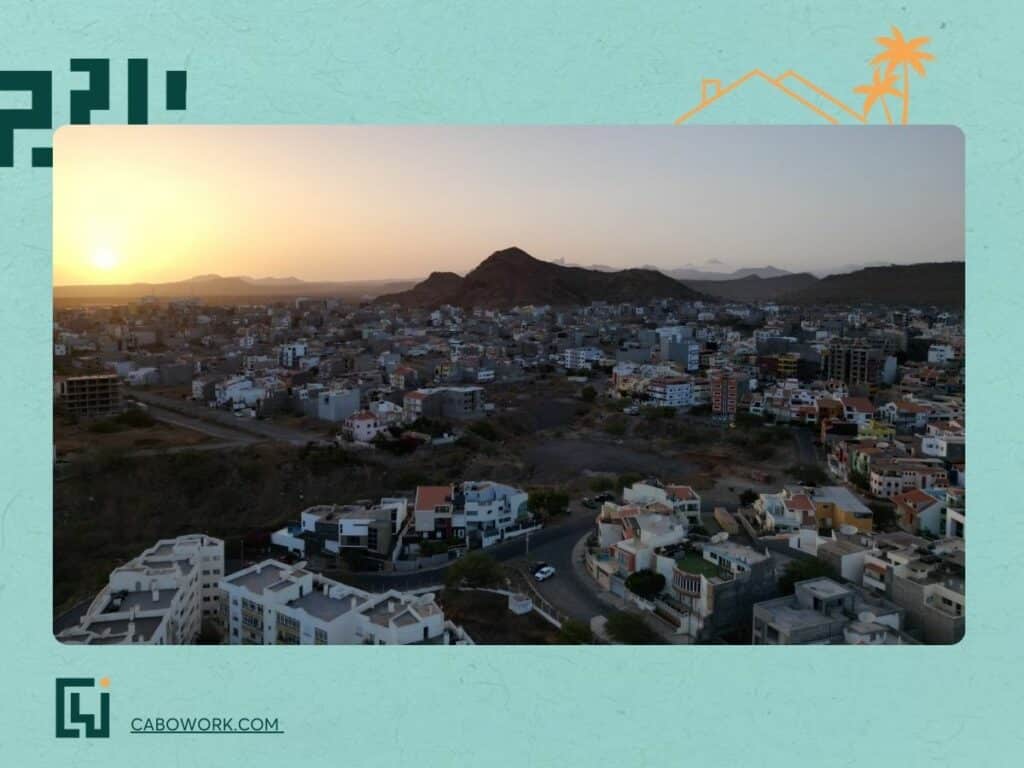

Santiago: Praia

The capital city of Praia on the island of Santiago is an exciting option for those looking to purchase property in Cape Verde.

Praia has a fast-growing tourism industry but also provides opportunities beyond tourism. There is a busy port and international airport, making travel easy. Property buyers will find a range of options in Praia, from modern apartments to historic colonial homes.

Santiago is also a wonderful island to explore, with popular spots like Tarrafal providing a wonderful escape from city life.